Sport Endurance, Inc.

Healthcare- Drug Related Products

Sport Endurance, Inc. is an innovative and rapidly growing provider of high quality nutritional and dietary supplements targeting health issues that include energy and weight loss, muscle growth, and sleep. The Company is the first to offer pharmaceutical grade gel cap forms of increasingly popular energy products and energy shots, establishing a profitable niche for itself in the lucrative $10 billion “energy” product market and the $68 billion nutritional supplement space, and is preparing to begin a massive marketing and distribution rollout of its product offering to more than 15,000 retail locations within the next quarter.

INVESTMENT OVERVIEW

• Growing market opportunity. The energy product phenomenon has been one of the most noticeable trends in the beverage and nutrition industries over the last decade, and the industry has grown at a 5 year CAGR of over 50% from revenues of approximately $400 million in 2000 to total revenues that exceeded $6.6 billion by 2007. Future growth is expected to be robust, with market research from both Goldman Sachs and Mintel predicting total revenues of over $10 billion by the close of 2010. SENZ is also well situated in the $68 billion annual nutritional supplements industry.

• Innovative and Broad Product Offering. Sport Endurance is the first player to introduce gel-cap forms of energy products, offering consumers numerous benefits over more traditional product lines in terms of price, appeal, and efficacy. In addition to its Energy Liquid Gel Cap, the Company’s product line includes complimentary products focusing on muscle mass and sleep/ relaxation, creating a comprehensive health and lifestyle brand, with additional product launches planned into the intermediate term.

• National Market Penetration. SENZ has launched an aggressive distribution and marketing strategy with the goal of reaching distribution to over 100,000 national retail locations within the next twelve months. The recent distribution agreement with Mr. Checkout Distributors is a major coup and will place the Sport Endurance product line in approximately 15,000 locations over the next fiscal quarter.

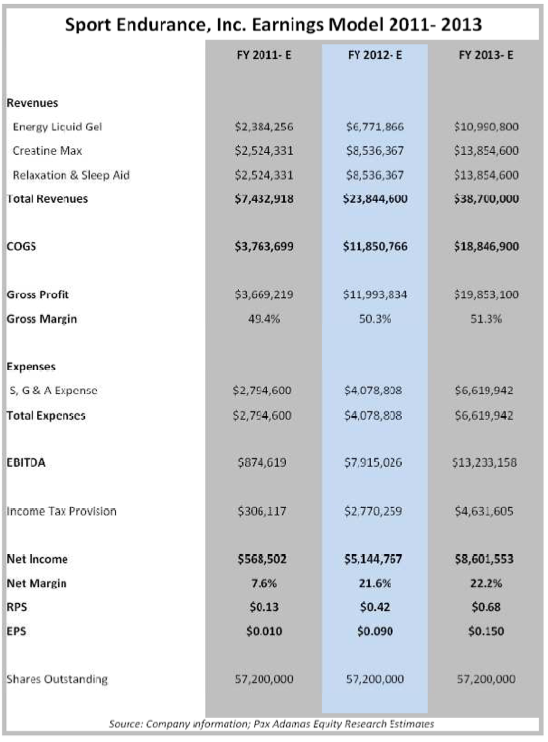

• Outlook. We believe SENZ is well positioned to attain national distribution of its products within the year, and attain substantial, accretive revenue and earnings growth into 2011 and beyond, as its products gain exposure. We anticipate that SENZ will top revenues of $7.4 million in 2011 with positive earnings, attaining annual revenues in excess of $38.7 million by 2013.

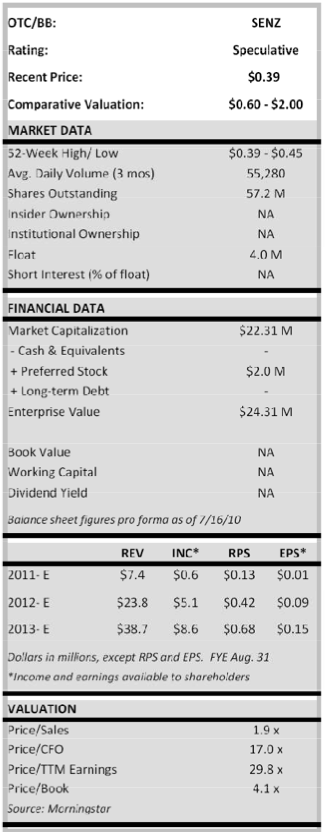

• Relative Valuation. At its current price of $0.39 per share, based upon the average trading range and market valuation of a peer grouping of comparable companies in the health and nutritional supplement space Sport Endurance is priced at a significant discount. By applying this peer grouping’s average price to earnings and price to sales multiples to

anticipated FY 2012 financial results we can arrive at an implied valuation for Sport Endurance of approximately $0.60 to $2.00 per share.

INVESTMENT THESIS

Sport Endurance, Inc. (OTC BB: SENZ) is an innovative and rapidly expanding developer, manufacturer, and marketer of a line of high quality dietary and nutritional supplements in liquid gel-cap form to consumer markets nationwide. The Company’s product line has been developed from a unique understanding of the health and dietary concerns that directly impact the lives of most Americans, with specific focus upon energy/ weight loss, muscle growth and maintenance, and sleep aids and relaxation. SENZ’s products are ideally situated at the intersection of complimentary market opportunities in nutritional supplements ($68 billion per annum, according to Nutrition Business Journal) and energy products (predicted to top $10 billion by 2010 according to both Goldman Sachs and Mintel).

Sport Endurance, Inc. (OTC BB: SENZ) is an innovative and rapidly expanding developer, manufacturer, and marketer of a line of high quality dietary and nutritional supplements in liquid gel-cap form to consumer markets nationwide. The Company’s product line has been developed from a unique understanding of the health and dietary concerns that directly impact the lives of most Americans, with specific focus upon energy/ weight loss, muscle growth and maintenance, and sleep aids and relaxation. SENZ’s products are ideally situated at the intersection of complimentary market opportunities in nutritional supplements ($68 billion per annum, according to Nutrition Business Journal) and energy products (predicted to top $10 billion by 2010 according to both Goldman Sachs and Mintel).

The Company’s delivery of nutritional supplements and energy boosts through the liquid gel format additionally represents the first combination of the energy drink with the soft gel format; this combination affords a number of advantages with its lower retail price point (compared to energy shots and energy drinks), more effective delivery system, and absence of sugar and carbohydrates than competitive products- we believe that the Company could easily mimic the growth parabola of 5 Hour Energy in the energy shot market (with approximately 60% market share of a rapidly expanding $300 million market niche that is growing at a 100% year-over-year growth rate). Founded in 2009, the Company entered the public marketplace through a reverse merger in June of 2010, and has recently launched its initial product line, which includes:

The Company’s delivery of nutritional supplements and energy boosts through the liquid gel format additionally represents the first combination of the energy drink with the soft gel format; this combination affords a number of advantages with its lower retail price point (compared to energy shots and energy drinks), more effective delivery system, and absence of sugar and carbohydrates than competitive products- we believe that the Company could easily mimic the growth parabola of 5 Hour Energy in the energy shot market (with approximately 60% market share of a rapidly expanding $300 million market niche that is growing at a 100% year-over-year growth rate). Founded in 2009, the Company entered the public marketplace through a reverse merger in June of 2010, and has recently launched its initial product line, which includes:

• Sport Endurance Energy Liquid Gel Caps- formulated with amino acids and B-vitamins, are designed to increase and maintain energy, while promoting weight loss

• Sport Endurance Creatine Max Liquid Gels- offers the strength, endurance, and muscle building benefits of creatine without the required massive dosages of 10-20 grams per day that competitive products demand, while also including L-Leucine, L-Glutamic Acid, and L-Arginine to enhance effectiveness

• Sport Endurance Relaxation and Sleep Aid- uses natural ingredients to encourage relaxation while replenishing nutrients that help the body deal with stress and improve sleep

Sport Endurance has developed critical relationships with partners in the manufacture and design of its innovative liquid gel offerings, notably with liquid gel manufacturer, Soft Gel Technologies, Inc. Soft Gel is a leading provider of soft gelatin capsule delivery systems and has worked in concert with SENZ to develop its proprietary product lines. The Company has further established a relationship with Traco Manufacturing, Inc. for the packaging of its product lines. In July of 2010, the Company launched its three product lines and has recently established a national sales and marketing initiative with a target of national market penetration to over 15,000 retail locations within the next fiscal quarter. To facilitate this, Sport Endurance recently signed a distribution agreement with Mr. Checkout Distributors, Inc. and its distribution network of over 100,000 grocery and convenience stores nationwide. In our view, these relationships, coupled with the first-to-market advantage offered by the liquid gel delivery system, puts the Company in an enviable position to benefit from the continued growth and development of the $68 billion nutritional supplement and the $10 billion energy product industries.

We anticipate that Sport Endurance will aggressively ramp up its sales in its first full year of operations (the Company’s fiscal year ends August 31), FY 2011, with sales of approximately $7.4 million, and positive earnings of $568,000, based upon total sales of 440,000 boxes of its products to distributors. As the Company expands its distribution channels aggressively, we anticipate that it will continue to enjoy substantial and continued growth, with conservative projections for FY 2012 at revenues of $23.8 million and earnings of $5.1 million. For fiscal 2013, we expect Sport Endurance to reach revenues of $38.7 million and increasing quality of earnings to $8.6 million.

INVESTMENT HIGHLIGHTS

• Multiple addressable markets for the Company’s energy liquid gel and nutritional liquid gel products with complimentary position in the $68 billion nutritional supplement industry and the $10 billion energy product industry.

• First-mover advantage with its liquid gel delivery system in the energy product space will open up substantial growth opportunities.

• Critical distribution partnership with Mr. Checkout Distributors provides SENZ with immediate national market penetration with a goal of product offerings in 15,000 national retail locations in the first quarter of fiscal 2011.

• Broad and expanding product suite with complimentary sleep aid/ relaxation and muscle mass/ retention (creatine) product lines, in addition to future planned offerings as part of an integrated healthy lifestyle brand.

• Strong brand identity developed through an aggressive planned marketing campaign using traditional media channels (television, radio, etc.) in addition to new media outlets such as Facebook and Twitter.

• Favorable earnings metrics and improving net margins.

RELATIVE VALUATION AND OUTLOOK

On a financial basis, consideration of revenues and earnings can provide us with a meaningful basis for comparison between the peer grouping of companies engaged in the drug related products industry and Sport Endurance, Inc. This comparative grouping currently trades at an average valuation of 0.9x revenues and at 13.9x earnings. The industry as a whole trades at an average valuation of 1.9x revenues and at 29x earnings. Based upon the innovative nature of the company’s liquid gel product offering, its position in growth segments of the energy product and nutritional supplements industries, existing distribution relationships, and strong projected revenue and earnings growth, we feel that this framework is a conservative one and represents only a fraction of the upside potential that investment in Sport Endurance, Inc. represents. Therefore, through application of the peer grouping’s average price to revenue and price to earnings multiples to our estimated FY 2012 financial projections for the Company, we can imply a relative valuation of approximately $0.60 to $2.00 per share.

INVESTMENT CONSIDERATIONS AND RISKS

There are a number of key investment risks to consider as Sport Endurance, Inc. moves forward with an aggressive expansion program to leverage the strength of its innovative product offering through a concerted marketing and distribution push designed to rapidly introduce the Company’s products to markets nationwide. The Company’s focus on this rapid national market penetration offers substantial upside from a corporate revenue and investment standpoint. However, due to the extremely early stage of corporate development and unresolved financing concerns, Sport Endurance still presents a number of risk concerns which should deter risk-averse investors at this time. Specific risks include the following general industry and specific corporate concerns:

• Development Stage- the Company is in a development stage with essentially no history of revenues or profits. Its growth and profitability will depend upon the successful rollout and distribution of its product offering.

• Limited Operations- the Company has a very limited history to judge its future prospects. There are no guarantees that the Company can attain its goals or achieve growth in the future. Future corporate development will also depend upon adequate financing, distribution channels, management, and a number of other factors.

• Capitalization- remains a primary concern. At present, the Company has insufficient financing to facilitate its expansion plans. Completion of significant financing efforts will be required to provide the necessary capital for SENZ’s expansion program.

• Competition- within the nutritional supplements and energy product industries is intense and widespread. As a relatively small company, Sport Endurance lacks the capitalization, market presence, and existing distribution and marketing channels of its competitors.

• Liquidity and price volatility- listed on the OTC Bulletin Board exchange, the Company’s stock is thinly traded, subject to price volatility, and appropriate only for risk-tolerant investors.

• Closely held- the Company is closely held by insiders whose ownership totals 99% of the outstanding shares. • Uncertainty regarding projections- our relative valuation is based on our estimates of future revenues and earnings, which are highly dependent upon certain assumptions relating to product expansion and success in strategic sales and marketing plans that may or may not unfold in the time frames represented in our earnings

model, if at all.

INDUSTRY OVERVIEW

Sport Endurance is positioned across complimentary and growing industry opportunities in the health and nutritional supplement industry and in the rapidly emerging energy product industry. This industry positioning has created a unique opportunity for the Company to capitalize upon a number of trends in both the nutritional supplement space and the energy product arena. Nutritional and dietary supplements, consisting of nutrients, such as vitamins, herbs, minerals, fiber, and fatty and amino acids, are intended to supplement the diet and provide a tangible health benefit and have long been used by millions of individuals worldwide. It was not until the passage of the Dietary Supplement Health and Education Act of 1994 (DSHEA), which regulated dietary supplements as a category of foods and not as drugsunder the FDA, however, that the rapid expansion of the industry began in the United States. Passage of this legislation substantially streamlined the introduction of new dietary and nutritional supplements into the market; dietary supplements no longer required pre-approval by the FDA before they could enter the market, while new ingredients need only be proven safe with a seventy five day moratorium on sales before they can be introduced, compared to potentially years were these supplements considered drugs. While dietary supplements are not permitted to make marketing claims to cure, mitigate, or treat disease (doing so would place them in the category of drugs and subject them to far more stringent FDA classification and oversight), supplements are allowed to make structure and function claims (stating that a product can help improve the structure or function of the body). This process has created the modern nutritional supplements industry.

According to market research from the Nutrition Business Journal and Gerson Lehman Group, the nutritional and health supplements industry was estimated at over $68 billion worldwide in 2007, and is anticipated to grow by some 12% to reach $76 billion by 2011. In the United States, the overall nutritional supplements industry is anticipated to grow to some $28.5 billion by 2011 from approximately $22.5 billion in 2006, according to Nutrition Business Journal. The viability of this industry has recently been validated with M&A transactions, most notably the July 2010 acquisition of NBTY, Inc. (manufacturer of Nature’s Bounty, MET-Tx, and Solgar nutritional supplements) by the Carlyle Group in a $3.8 billion transaction, representing a roughly 47% premium to market value in a move that is anticipated to spur a new round of consolidation within the industry.

Complementing its position in the nutritional supplements industry, Sport Endurance is additionally well positioned within the explosive growth energy product industry, which has been the most noticeable trend in the beverage industry in the new millennium. From overall revenues of approximately $400 million in 2000, the US industry has witnessed a 5 year CAGR of more than 50%, reaching total revenues of $ 6.6 billion by the end of 2007. According to market research from both Goldman Sachs and Mintel, the energy product segment is expected to reach annual revenues of $10 billion by 2010. The competitive landscape of the energy products market is a unique one within the beverage industry, insofar as it is not dominated by large, dominant corporations as is the soft-drink or bottled water segments, but is instead characterized by strong competition between a large number of smaller companies, focusing on specific niche demographics. While there has been some significant movement into this space from major beverage conglomerates (such as Coca Cola’s Full Throttle brand and Pepsi’s Sobe offering, purchased for $370 million in 2000), the majority of the space is dominated by smaller and independent players.

Historically, the undisputed market leader has been the eponymous Red Bull brand offering, which has market share of approximately 42.5% according to Datamonitor. Other leading brand’s include Hansen’s Monster Energy with market share of approximately 14.4% and Rockstar with market share of approximately 11.4%. Increasing differentiation in thecategory is beginning to come from a profusion of the formulations and ingredients used to boost energy, including green tea, yerba mate, gingko bilboa, vitamin C, shizandra, açai, ginger, and cranberry extracts. With 1,000 plus players currently in the energy product market, we are likely to see significant consolidation over the near-future, with an increasing emphasis on the development of unique market positions and effective distribution networks paramount. Energy products represent an especially dynamic category due to a large number of new product launches with a great deal of product innovation, a wide range of small and new companies competing in the segment, and marketing campaigns that target specific consumer interests and demographic niches. In the United States alone, there were 321 new sports or energy products introduced during 2006, compared to 149 new launches in 2003, according to ProductScan Online.

According to a recent survey from the National Marketing Institute, over two thirds of Americans are very concerned about their energy levels, with approximately 21% of respondents saying they tried to manage tiredness, while 38% revealed that fatigue is their biggest fear of aging. According to Mintel, mental alertness is a reason that 55% of those over age 35, and 40% of those under age 35, use energy beverages. The use of energy products is also widespread among teenagers, with a recent survey from Simmons Research showing that 31% of US teenagers consume energy beverages, representing some 7.6 million consumers in this demographic alone. Driven by a highly receptive consumer market, the energy product segment is expected to enjoy sustained growth in sales and popularity; they are regarded as the next high-growth segment of the beverage industry. Increasingly, we are also seeing the development of synergies between the energy drinks and alcoholic beverages segment of the market. With the popularity of energy drinks as a mixer in alcoholic beverages at bars (notably the ubiquitous Red Bull and vodka), the segment is now beginning to see the introduction of alcoholic energy drinks, such as Anheuser-Busch’s 180 Red with Gobi. Another emerging trend within the segment is the increased popularity of lower fat and low or sugar-free product offerings amongst consumers. One of the principal reasons energy products provide energy is because they contain extremely high amounts of sugar.

Another notable trend in the energy space, is the emergence of so-called “energy shots” such as Living Essential’s 5- Hour Energy shot, which currently controls approximately 60% of this new market niche, with sales of approximately $169.7 million (out of a total market size of $300 million). Energy shots contain mostly caffeine, vitamin, and amino acids in small shots of 2 to 3 ounces, but lack the high sugar and sugar derivative content of traditional energy drinks. While the price point of these energy shots is generally higher than traditional energy drinks, manufacturers have begun to inform consumers about the manifold advantages (lower calories, minimal carbs, the absence of sugar) energy shots offer relative to energy drinks, leading to market growth of an estimated 100% in the past year alone. With its innovative liquid gel packaging, we believe that Sport Endurance is situated at the forefront of a similar, explosive growth market niche that encompasses both the nutritional supplements and the energy product industries.

MANAGEMENT TEAM

CEO Robert Timothy- represents the dynamic force behind the development of the Company’s strategic initiatives and is responsible for the development of the Company’s marketing strategies, product concepts, establishing distribution channels, branding initiatives, creating licensing opportunities, recruiting a management team for the growth of the Company, and for securing investment capital to ensure SENZ’s continued growth. Mr. Timothy brings an extensive background in the financial services industry, and spent over a decade as a financial professional in the high net worth client group of Fidelity Investments.

CFO Ronald Schuurman- brings more than 25 years of management experience in retail product sales, marketing and procurement, with positions held at several major retail chains and retail product companies. Mr. Schuurman spent two decades with Smith’s Food & Drug as a supervisor where he was responsible for merchandising and operations for all non-perishable departments. There he oversaw $450 million in annual sales. Mr. Schuurman also spent several years with national chain, Winn-Dixie Stores, Inc., where he oversaw product selection, pricing, and developing promotions, and overseeing more than $350 million in annual sales.

MARKETING AND DISTRIBUTION

To leverage the qualitative advantages of its product offering, in terms of consumer appeal, pricing, and value, Sport Endurance has developed an innovative multi-tiered marketing strategy designed to rapidly expand its national market penetration, introducing its product line to 15,000 retail locations nationwide over the next fiscal quarter. Initially, the Company will focus on a grass-roots marketing and distribution push, focusing on the existing industry relationships of its management team and through its relationship with Mr. Checkout Distributors. The Company has recently signed a pivotal distribution agreement with Mr. Checkout Distributors, Inc., a leading distributor of food and beverage products to its network of more than 100,000 grocery and convenience stores nationwide. Under this recently signed distribution agreement, and in concert with an aggressive marketing push, the Company intends to initially focus its distribution efforts to 15,000 of these locations, with a secondary push to an additional 30,000 locations. As the Company increases its national sales presence and begins to generate significant revenues, they further intend to pursue traditional media such as radio and television spots, commercials before theatrical movies, and product sampling at large entertainment events, developing and cultivating the Sports Endurance brand identity directly to consumers.

Disclaimer- Pax Adamas Holdings, LLC’s Pax Adamas Equity Research Profile is written and produced as an information source only. We are not a registered investment advisor or broker dealer, and this is not to be construed as a solicitation to buy or sell securities. No information in this report should be construed as an endorsement to either buy or sell securities mentioned in this report. The writer(s) who prepared this report rely on publicly available information which Pax Adamas Holdings cannot guarantee to be error free or factually accurate. All conclusions in this report are deemed reasonable and appropriate by the author.

Certain statements in the report pertaining to the Company’s earnings, development, and future growth potential are considered “forward looking” statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and as defined in the Private Securities Legislation Reform Act of 1995. Pax Adamas Holdings intends that such statements about a company’s future expectations, including future revenues and earnings, and all other forward looking statements be subject to the safe harbors created thereby. Because such statements are subject to risks and uncertainties, actual results may differ significantly from those expressed or implied by such forward-looking statements.

The information contained in this report has been carefully complied from sources deemed to be reliable, but we do not guarantee that it is accurate or complete, and it should not be relied upon as such. Opinions expressed are current opinions as of the date appearing on this material only. While we endeavor to update material on a reasonable basis, we are not obligated to do so and there may be regulatory, compliance or other reasons that prevent us from doing so. This report may not be construed as investment advice. Investing in securities is speculative and carries a high degree of risk. Past performance does not guarantee future results. All information contained in this report should be independently verified. Investors are reminded to perform their own due diligence with respect to any investment decision. Independently investigate and understand all risks before making any investment.

Pax Adamas Holdings, LLC and/or its officers and employees have been compensated $2,000 by a non-affiliated third party (Securities Magazine, Inc.) for work involved in the preparation and production of this report. Officers, directors, and employees of Pax Adamas Holdings, including persons involved in the preparation or issuance of this material do not hold an equity position in the aforementioned securities at this time. Per Share Data reflects current or otherwise indicated share numbers and could be affected by actual future share dilutions. Prices of securities and price to financial ratios are for recent data and may vary based on the day the data was obtained for individual companies. Some or all of the Securities discussed herein may be speculative in nature and thus readers of this material are advised to CONDUCT DUE DILIGENCE BEFORE PURCHASING ANY SECURITY.

©2010 Pax Adamas Holdings, LLC. All rights reserved. This report and all content herein including and without limitation, text, images, and graphics are protected by all applicable copyright and trademark laws and may not be reproduced in whole or in part. Unless otherwise specified, no one has permission to copy or republish, in any form, any information found in this report.